The CA Probate Threshold is Changing. Do You Still Need a Trust?

If you live in California and have an estate plan—or are considering one—you may have heard that the probate threshold is increasing. This change has sparked a common question: Do I still need a trust?

While the new probate limit may reduce the number of estates that must go through probate, a trust remains a powerful estate planning tool that offers significant advantages beyond just avoiding probate.

Understanding the New Probate Threshold

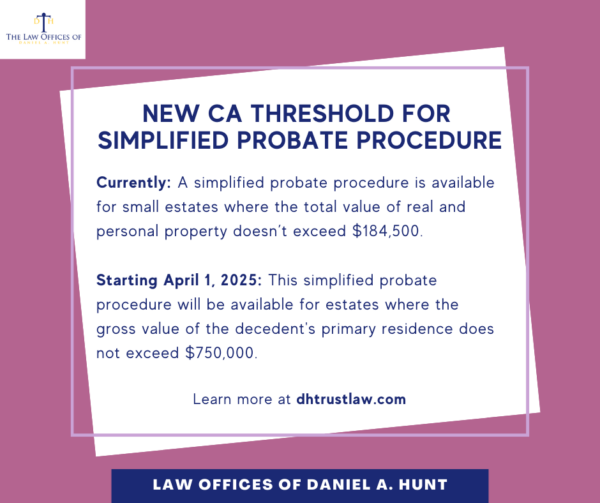

Currently, if your estate is worth more than $184,500 and you die without a will or with only a will, your estate must go through the California Probate Court before it can be distributed to your heirs. For decedents who passed away on or after April 1, 2022, a simplified probate procedure is available for small estates where the total value of real and personal property does not exceed $184,500. Properties exceeding this value typically require a formal probate proceeding, which is both time-consuming and costly.

However, starting April 1, 2025, Assembly Bill No. 2016 will offer this simplified probate procedure for estates where the gross value of the decedent’s primary residence does not exceed $750,000. This substantial increase in the probate threshold will allow more Californians to utilize expedited procedures.

Be aware that the new expedited process only covers the value of the decedent’s primary residence. If the decedent had multiple properties or if the property is no longer their primary residence, then that piece of real estate will not qualify.

Does This Mean You No Longer Need a Trust?

While fewer estates will be subject to a full probate proceeding under the new threshold, many people will still benefit from a revocable living trust. Here’s why you may still need one:

1. Avoid Complications

With a simplified probate petition, all estate beneficiaries will be on title to real property. This works well if you have a solo beneficiary. But what if you have multiple beneficiaries and wish to sell the family home? Worse, what if they disagree on what to do with the real estate? In many cases, it’s still better to use a trust so a successor trustee can efficiently manage and distribute estate assets.

2. Avoid Probate Completely

While the simplified probate procedure is faster than a full-blown probate proceeding, you’d still need to file an affidavit with the Probate Court and attend a hearing. But with a trust, you can avoid all involvement with the Probate Court, as your successor trustee will administer your trust privately outside of court.

3. Avoid a Court-Appointed Conservatorship

A trust allows for seamless management of your assets if you become incapacitated. If you have a trust and you lose the mental or physical capacity to manage your affairs, your successor trustee could take over these tasks. Without a trust, your loved ones may have to go to court for a conservatorship to manage these matters, which is expensive and time-consuming.

4. Provide for Minor or Special Needs Beneficiaries

If you have young children or beneficiaries with special needs, a trust is essential. It allows you to:

- Control how and when assets are distributed.

- Name a trusted person to manage funds for minors.

- Preserve government benefits for special needs individuals.

5. Protect High-Value Assets

Even with the increased probate threshold, many California homes exceed $750,000 in value. If you own high-value real property and/or a larger estate, a trust ensures that your home and assets can pass directly to your heirs without probate delays or costs. Certain types of trusts can also offer tax advantages for larger estates.

Who Might Not Need a Trust?

While a trust will still benefit many Californians, it may not be suitable for everyone. If your home value is well below $750,000, you have no minor beneficiaries, and your assets are already designated to transfer outside of probate (such as through beneficiary designations on retirement accounts or payable-on-death bank accounts), then a trust may be less critical.

However, you should still review your estate plan with an experienced estate planning attorney to ensure your estate plan reflects your wishes and current California inheritance laws.

If you have any questions about whether you still need a trust, feel free to contact our law firm.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.